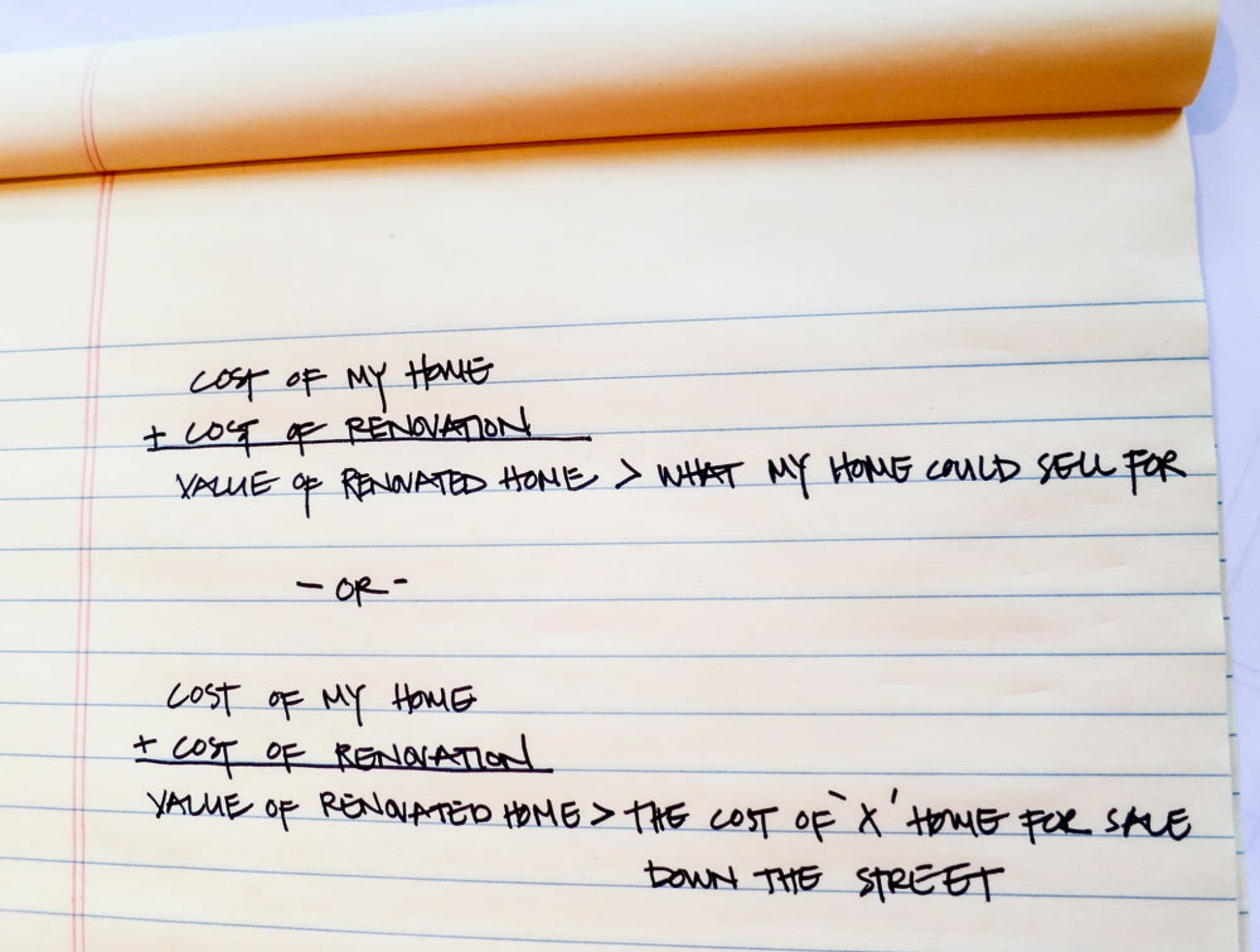

The question of value is one that we address on a regular basis here at CG&S. Our clients want to beautify their homes but are unable to make the numbers “add up” in all cases. What this often means is that they can’t justify the cost of the renovation when they have the perception that buying another house would solve their problem for less cost. The equation looks like this for many:

While many decisions in one’s life can be made or justified purely based on dollars (and we’ve all been schooled that one’s home is their greatest investment), we feel that the decision to renovate requires a broader study of one’s life balance, lifestyle, and goals before getting down to the dollars and cents.

Is this your long-term home?

You love the neighborhood. It’s walkable. The old-growth trees are amazing. Your commute is a breeze (OK, OK, unless you work from home or in the backyard studio, this is a relative subject). While it’s maybe not the “best”, but (and perhaps because of this) you love it; it’s comfortable and feels like “home”. Your neighbors are great and the school is working for you. You have lived there for many years and your house is filled with happy memories of life’s milestones. Or, conversely, you recently bought specifically and strategically in this location and are ready for life to unfold before you. If you’re nodding along, then this ‘value’ should weigh heavily in your remodel equation.

Is 90% of your house working great for you already?

Chances are good that something other than the zip code caused you to sign up for a mortgage on this house. It’s the portion of your home that you don’t love or doesn’t work for you (now or anymore) that is our specialty. And this last little bit is what makes your home truly unique to you and your family. Adjusting that non-working portion tailor-fits your home to your style and sense of comfort. This doesn’t mean the renovation will turn your home into the next art museum or James Bond set—unless that’s your thing. It means that it will take your house from “good” to “great”, from “mine” to “mine”, or from “it works” to “it’s perfect”.

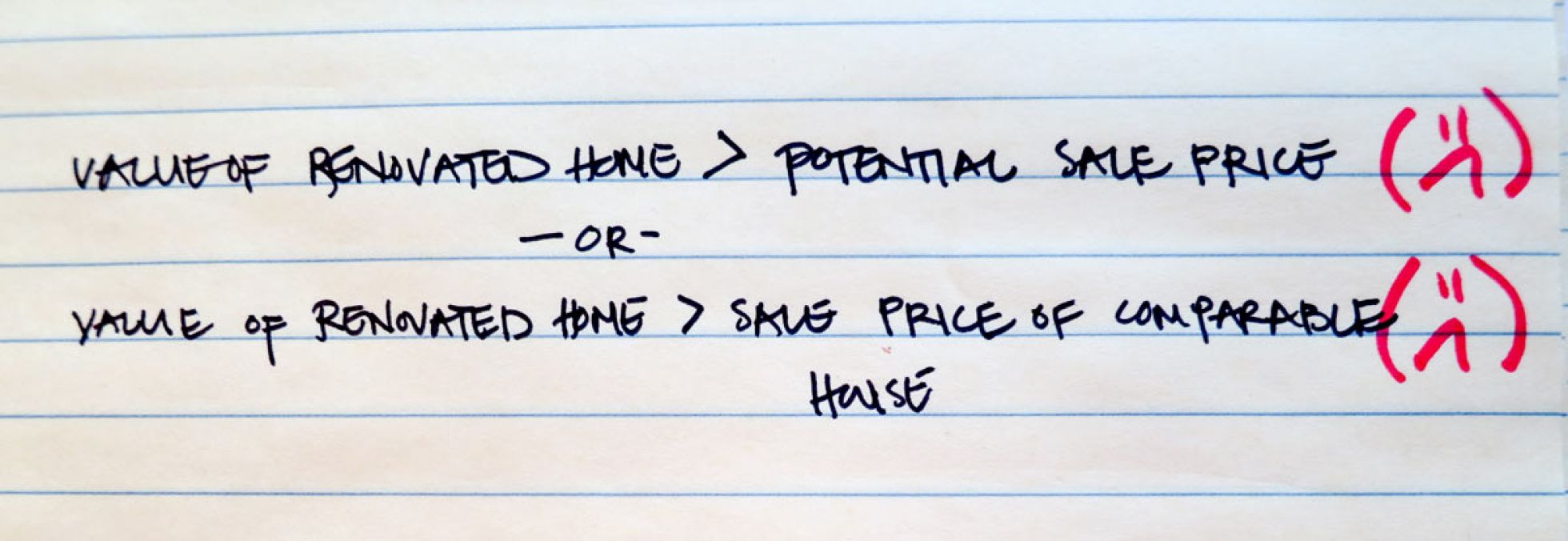

Now that you’re emotionally bought into the idea that this renovation needs to happen yesterday, let’s go back to the dollars and cents. When we left off, the equation looked something like this:

Cost is the necessary evil to home improvement work. Hopes, dreams and what if’s cost money—and often more than first assumed. We help our clients digest the emotional cost of a project by helping them grasp the financial impact in the context of value rather than raw cost.

Everyone’s home has a current value in today’s market. Sometimes clients come to us having recently acquired an appraisal so they know that value. Other times, they are coming to us with a need and are not, at first, focused on the numbers. Once we get a program for the proposed project and are able to put first blush-project costs to the work, we like to do a quick litmus test of the proposed project to help them better understand the final value of their home as it compares to the other homes in their neighborhood. As ethical designers, we don’t want to blindly encourage a nervous client to overbuild in their neighborhood.

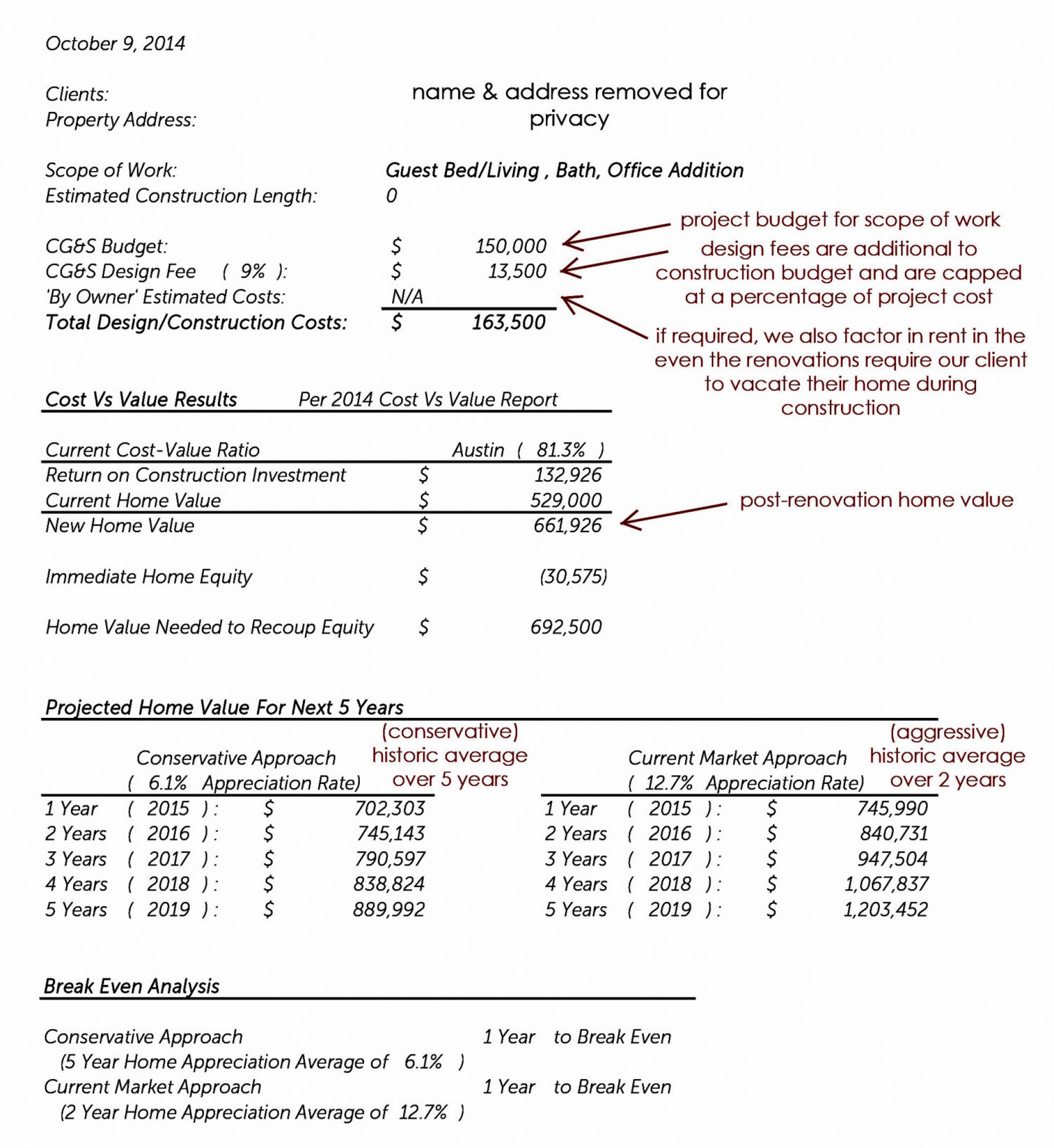

To compile our test data, we look to resources like Zillow with the full understanding that it’s not a perfectly accurate tool, but assuming that it is roughly equally inaccurate across all properties. Using the current home value from here is the first number we plug into the equation. We factor in things like the average return on investment for construction projects in Austin to arrive at a more realistic post-renovation value of the home.

We then look at how that post-renovation home value stacks up against the neighborhood profile and other comparable homes in the area. This gives clients an assurance (or proof that) they are not overbuilding for their area (or that they are, if that happens to be the case). Some clients are fine with overbuilding and want the home that they want in the neighborhood they love, while other clients are more conservative. We cater to all but want to be fair and ensure that all of our clients are informed and as comfortable as possible moving forward in this huge life decision to renovate.

The next logical question is how long the cost of the work will take to recoup in the market. To find out, we run calculations to generate both conservative as well as aggressive home appreciation values and project those values out over the years to determine what the break-even point is. Overbuilding in a neighborhood but knowing that the equity breaks even in a year can be an instrumental piece of information for clients. In the spirit of full disclosure, we try to provide this for our clients.

These quick tools let us provide our clients with some peace of mind in knowing whether or not their projects are fitting within their neighborhood cost profile. They also, then, have a handle on their long-term investment picture—at least in simple terms. We don’t go so far as to factor in interest paid on loans or the like, but in general terms, we try to let them look ahead a little bit and plan accordingly. Sometimes the picture looks great and we get a green light, other times, the study raises concerns that require consideration and possibly a change of course. Whatever the solution, we are here to help our clients along the way from start to finish—just another one of the benefits of our design/build business model.

Now, let’s talk about that home office or backyard studio space.